Reconciliation is also used to ensure there are no discrepancies in a business’s accounting records. This works by comparing 2 sets of records and is a way of making sure all the figures are correct and match up. Reconciliation has become a byword for consistency, accuracy, and thoroughness. Account reconciliation is an essential process that can feel a lot like a puzzle. You’re matching numbers, finding discrepancies, and ensuring everything makes sense.

Tips for a Successful Bank Reconciliation

For lawyers, account reconciliation is particularly important when it comes to trust accounts. In fact, most jurisdictions have requirements for trust account reconciliation. For example, you may need to reconcile your trust account bank statement with client balances at a specific frequency, such as monthly or quarterly. Using accounting software like QuickBooks will automatically import transactions from the bank, eliminating the need for manual data entry. Below is an example of a bank reconciliation in QuickBooks; it shows a difference of £14,387.05, with 12 transactions to reconcile.

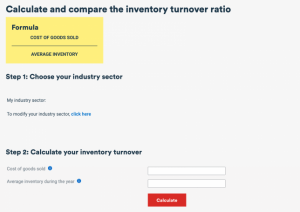

What are the two basic methods of account reconciliation?

- For example, a business might compare its cash account records (from its internal ledgers) with its monthly bank statement provided by its financial institution.

- Businesses often use credit cards for expenses, and these transactions are recorded in the internal ledgers.

- A chargeback can commonly occur in a business, especially if you’re making sales online.

- Regular account reconciliation is necessary to maintain visibility and control over your company finances.

- If the numbers at the end don’t match, accountants dig into the reasons for the differences.

For example, reconciling general ledger accounts can help maintain accuracy and would be considered account reconciliation. While reconciling your bank statement would be considered a financial reconciliation since you’re dealing with bank balances. Account reconciliation is a vital process that helps businesses maintain their financial health by identifying errors, preventing fraud, and ensuring the validity and accuracy of all financial statements. Account reconciliation is typically carried out at the end of an accounting period, such as monthly close, to ensure that all transactions have been accurately recorded and the closing statements are correct. Reconciliation for accounts receivable involves matching customer invoices and credits with aged accounts receivable journal entries. It makes sure that your customer account write-offs are correctly recorded against the Allowance for Doubtful Accounts and that discrepancies are addressed.

Streamlining the reconciliation process

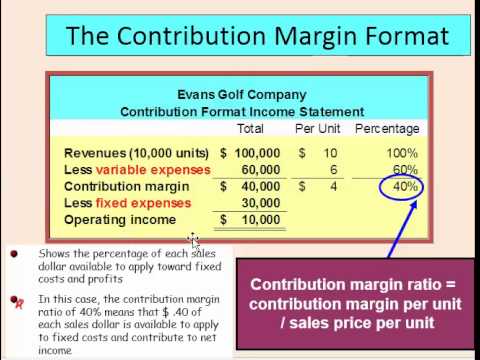

The process is particularly valuable for companies that offer credit options to their customers. They can then look for errors in the accounting records for customers and correct these when necessary. In accounting, reconciliation refers to a process a business uses to ensure that 2 sets of accounting records are correct. Accountants compare the general ledger balance for accounts payable with underlying subsidiary journals. GAAP (generally accepted accounting principles) requires accrual accounting to record accounts payable and other liabilities in the correct accounting period.

What Is Account Reconciliation and Why Is It Important for Your Business?

Real-time automated payment reconciliation reports are generated to reconcile with the general ledger when batch payment runs are completed using AP automation and global mass payments software. Larger businesses with several branches may also need to complete intercompany reconciliations. Balance sheets and profit and loss statements are both essential resources for determining the financial health of your business. Accrual accounting is more complicated but provides a better insight into the financial health of your business. For example, when you pay your utility bill, you would debit your utility expense account, which increases the balance and credit your bank account, which decreases the balance.

Check for Bank Errors

This practice helps identify and rectify discrepancies, including missing transactions. In essence, reconciliation acts as a month-end internal control, making sure your sets of records are error-free. Businesses often use credit cards for expenses, and these transactions are recorded in the internal ledgers. At the end of the deferred revenue definition month, the credit card statement arrives and should reflect the same transactions and ending balance as in the general ledger. But, if there are discrepancies due to pending charges or interest fees, reconciling accounts helps identify and correct the amounts owing, ensuring the company’s records match the external document.

The correction will appear in the future bank statement, but an adjustment is required in the current period’s bank reconciliation to reconcile the discrepancy. Reconciling an account is an accounting process that is used to ensure that the transactions in a company’s financial records are consistent with independent third party reports. Reconciliation confirms that the recorded sum leaving an account corresponds to the amount that’s been spent and that the two accounts are balanced at the end of the reporting period. To fix reconciliation discrepancies in the reconciliation process, we need to use journal entries.

This highlights the significance of accurate accounting reconciliation in detecting and preventing fraudulent activities within an organisation. By reconciling financial records, such as bank statements, invoices and receipts, businesses can identify discrepancies and irregularities and protect themselves against potential fraud. A bank reconciliation in accounting is a highly recommended check to ensure that bank statements match accounting transactions. Reconciliation in accounting—the process of comparing sets of records to check that they’re correct and in agreement—is essential for ensuring the accuracy of financial records for all kinds of businesses. For the legal profession, however, regular, effective reconciliation in accounting is key to maintaining both financial accuracy and legal compliance—especially when managing trust accounts. The very basis of double-entry accounting is itself an internal reconciliation.

For his first job, he credits 5000 ZAR in revenue and debits an equal amount for accounts receivable. Johannes has therefore achieved reconciliation because a refresher on debt both his credits and debits are equal. A business will observe the money leaving its accounts to calculate whether it matches the actual money spent.

Similarly, if there are deposits appearing in the bank statement but are not in the cash book, add the entries to the cash book balance. The bank discovered that the mysterious transaction was a bank error, and therefore, reimbursed the company for the incorrect deductions. Rectifying the bank errors bring the bank statement balance and the cash book balance into an agreement. Reconciliation is an accounting procedure that compares two sets of records to check that the figures are correct and in agreement and confirms that accounts in a general ledger are consistent and complete.

The company can now take steps to rectify the mistakes and balance its statements. The trial balance that lists and totals general ledger account balances should have equal debit and credit totals to reflect double-entry accounting and posting of all accounts to the general ledger. Balance sheet accounts with subsidiary ledgers (sub-ledgers) include accounts receivable, inventory, fixed assets, and accounts payable. Reconcile general ledger accounts to balances of short-term investments free charity event fundraiser online invitations with a maturity period of 90 days or less, using brokerage and investment firm statements or financial institutions statements. Cash equivalents include treasury bills, commercial paper, money market accounts, marketable securities, and short-term government bonds. A business that processes a few transactions a month may be able to reconcile its accounts monthly, while a larger business with hundreds of transactions daily may need to reconcile its accounts more frequently.

It also helps to flag any discrepancies, mistakes, or fraud in the company’s books. Any of these could have a serious detrimental impact on the financial health of a company. So, businesses should perform regular check-ups because these can contribute to their success.

If the numbers at the end don’t match, accountants dig into the reasons for the differences. They then fix any mistakes or missing transactions by making the necessary adjustments in the records. This helps ensure that the company’s financial information is accurate and error-free. For example, a business might compare its cash account records (from its internal ledgers) with its monthly bank statement provided by its financial institution.

Setting realistic expectations for AI implementation is key to understanding your ROI on AI spending. Account reconciliation is a fundamental step in the financial close and sets the basis for closing the accounts. But given the large volumes of data, matching records or reconciliation can be a strenuous activity. Reconciliation helps identify and fix errors like misapplied payments, ensuring accurate financial information. For example, real estate investment company ABC purchases approximately five buildings per fiscal year based on previous activity levels.

A company would then be able to put right any mistakes in its financial statement. The result would give a far more accurate picture of the company’s true financial status. Find out how it all works as we examine the benefits of different types of reconciliation in accounting. However, you typically only have a limited period, such as 30 days from the statement date, to catch and request correction of errors. The frequency of your reconciliation process can be determined by the size and type of business.